In a year defined by market fragmentation, accelerating digital transformation, and shifting global macro forces, the world’s most influential FX leaders will gather in Barcelona for TradeTech FX 2025. As Europe’s flagship FX conference, it brings together over 800 senior buy-side, sell-side, fintech, and regulatory professionals to shape the next era of currency markets.

A Buy-Side-Only Launchpad for Innovation

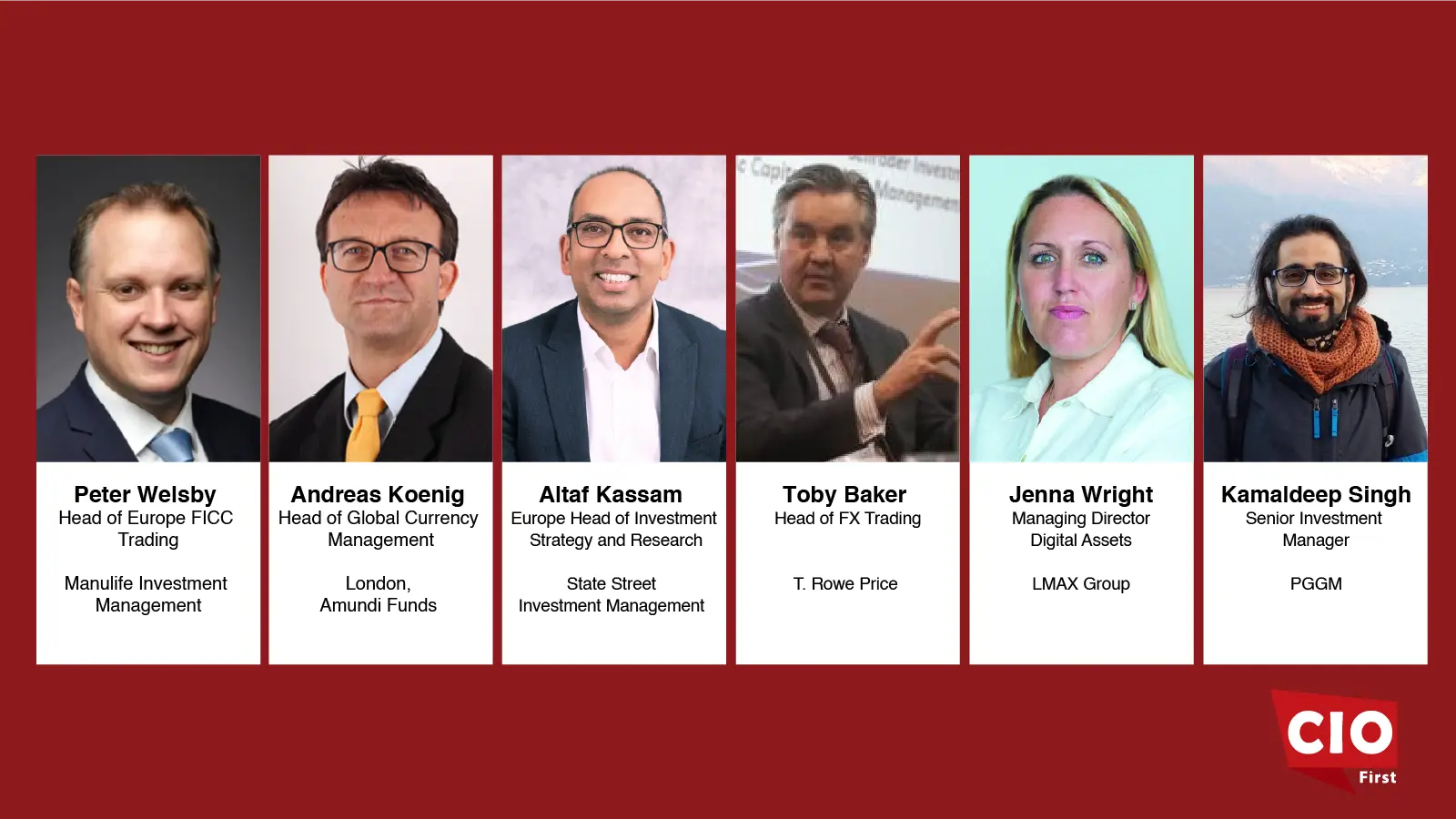

The event begins with the exclusive Buy Side Innovation Day, held under Chatham House Rules and limited to 160 buy-side participants. This day sets the tone for the week with a macro-level assessment of FX as an asset class, led by Amundi’s Andreas Koenig and moderated by FXStreet’s Yohay Elam. Panels explore how leading desks are generating alpha, adapting execution strategies in real time, and using advanced visual dashboards to enhance trader decision-making.

Debates on the ‘buy versus build’ technology dilemma and a private Head Trader Think Tank featuring T. Rowe Price’s Toby Baker perspectives to the table. The day concludes with ‘Meet the Providers’ sessions, where buy-side desks benchmark the most innovative liquidity and technology offerings from firms like Societe Generale, CME Group, LSEG, and HSBC.

What to Expect in 2025

Across three days, TradeTech FX 2025 will dive into the biggest forces reshaping currency markets, from the convergence of digital assets and traditional FX to the rapid rise of AI-driven trading strategies. Manulife’s Peter Welsby will open Day One with a keynote on future-proofing FX desks amid technological disruption and competitive talent markets.

Core themes will include liquidity evolution in fragmented markets, cross-asset workflow automation, next-generation algos, derivatives electronification, and the macroeconomic shifts driving currency volatility. Oxford-style debates on multi-asset versus specialist desks and the future of the dollar will spark high-level discussion, while dedicated sessions spotlight portfolio allocation strategies, corporate treasury structures, EM FX markets, and frontier currency opportunities.

Also Read: The Hybrid IT Dilemma: Cloud-First or Cloud-Smart?

Agenda

The program spans mainstage panels, Oxford-style debates, interviews, and curated roundtables. Agenda includes discussions on trading strategy, market structure, and technology innovation, with parallel tracks on portfolio management and corporate treasury. Global macro strategy, machine learning, and digital assets, with sessions on hedging strategies, Global FX Code updates, and building the next generation of trading leaders, will also be on the main agenda. Throughout, the agenda is designed for practical insight, candid debate, and cross-industry collaboration, all within an intimate and highly interactive format.

Speakers

TradeTech FX 2025 features an unparalleled lineup of global FX leaders, from senior buy-side heads of trading and portfolio managers to central bank officials and top fintech innovators.

Key speakers include:

- Peter Welsby – Head of Europe FICC Trading, Manulife Investment Management

- Andreas Koenig – Head of Global Currency Management, London, Amundi Funds

- Altaf Kassam – Europe Head of Investment Strategy and Research, State Street Investment Management

- Toby Baker – Head of FX Trading, Rowe Price

- Jenna Wright – Managing Director, Digital Assets, LMAX Group

- Kamaldeep Singh – Senior Investment Manager, PGGM

They are joined by influential figures from UBS, AXA IM, Schroders, State Street Digital, LSEG, CME Group, Goldman Sachs, and the Bank of England, offering delegates direct access to the minds shaping the future of currency markets.

Why Does the Event Matter?

TradeTech FX stands apart because it is built by and for the industry. The agenda is the result of over six months of research and advisory input from global FX leaders, ensuring every discussion reflects real-world challenges and opportunities.

For buy-side firms navigating fragmented markets, for traders adopting AI-driven execution, for portfolio managers managing geopolitical risk, and for fintech innovators reimagining the FX ecosystem, this is where strategy, technology, and market insight converge. TradeTech FX 2025 isn’t just where the conversation happens, it’s where the future of FX is forged.

To explore full agenda, click: https://tradetechfx.wbresearch.com/